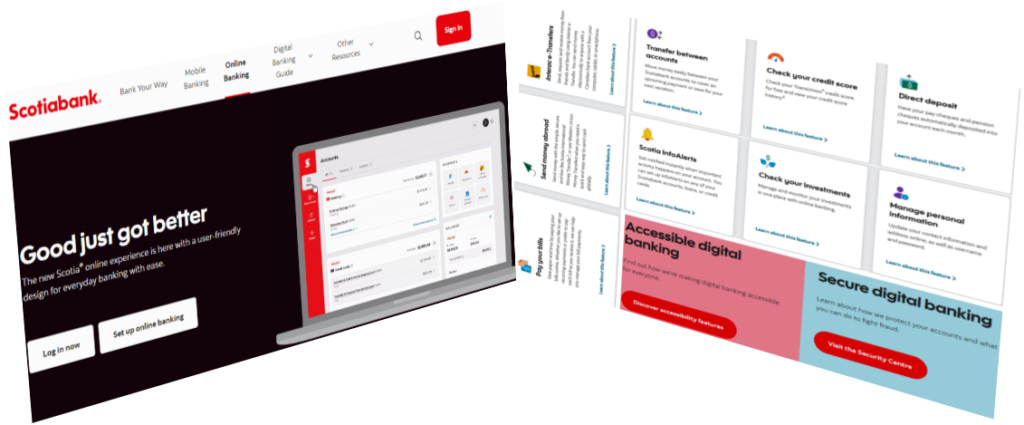

Scotiabank Online Banking is a secure, web-based platform enabling customers to manage their finances. Designed for accessibility, it integrates with Scotiabank’s mobile app, providing users with a seamless experience for personal, business, and credit card account management. Scotiabank Online Banking 2024 supports balance inquiries, payments, fund transfers, and investment services.

Description

Discover hassle-free banking backed by advanced tech and customer-focused solutions with Scotiabank Online Banking 2024.

Key Facts

- Scotiabank Online Banking includes easy fund transfers, bill payments to over 10,000 billers, investment management, and detailed credit card tracking.

- Its customizable dashboard and two-factor authentication enhance user control and security.

- Mobile-friendly features like cheque deposits and digital wallets ensure banking is both modern and efficient.

About Scotiabank Online Banking 2024

Services offered by Scotiabank Online Banking

- Account Management: View balances, transaction history, and e-statements.

- Payments and Transfers: Includes bill payments, Interac e-transfers, and cross-border fund transfers.

- Investment Services: Access brokerage accounts, and manage mutual funds and retirement plans.

- Credit Card Management: Pay bills, review statements, and redeem rewards.

- Business Solutions: Manage business accounts, credit cards, and transfers online.

- Mobile Features: Deposit cheques, set alerts, and make NFC payments.

- Customer Assistance: 24/7 online support and secure chat options.

Advantages:

- 24/7 Access: Manage accounts anytime, anywhere.

- Wide Accessibility: Available on web and mobile platforms.

- Security Features: Two-factor authentication and encryption ensure safety.

- Custom Alerts: Monitor account activity and avoid overdrafts.

- Environmentally Friendly: Digital records reduce paper waste.

Disadvantages:

- Technical Glitches: Platform outages occasionally occur.

- Learning Curve: Some users find navigation challenging.

- Fees: Premium services may incur additional charges.

- Limited Personalization: Certain complex needs still require branch visits.

Customer Feedback and Reviews of Scotiabank Online Banking

Scotiabank Online Banking reviews on various platforms reflect mixed customer sentiments. On Trustpilot, 62% of users rated their experience as poor, citing unresponsive customer service during outages. Customers frequently mentioned delays of 48 hours or more in resolving Scotiabank online bank login issues.

Reviews on Sitejabber gave an average rating of 1.2 stars, with 75% reporting frustration over account freezes. Many users expressed dissatisfaction with the mobile app’s inconsistent functionality, especially for cross-border transfers, which they claimed failed 28% of the time. On Google Play, the app holds a 3.5-star rating, with 40% of reviews applauding ease of navigation while 22% highlighted unexpected fees.

Ratings of Scotiabank Online Banking

Investor ratings reflect strong performance in security and feature depth:

40% of investors praised for robust Scotiabank online bank security and features and rated it 5 stars. 35% rated it 4 stars for a user-friendly interface. 15% investors cited glitches and limited customer service, rating it 3 stars. 7% gave it 2 stars by highlighting delays in dispute resolutions. While 3% rated it 1-star for specific issues with accessibility or fraud incidents.

At the same time, 40% of customers rated it 5 stars for secure and feature-rich experiences. 30% of customers appreciated the user-friendly design and mobile app integration and gave 4 stars. 20% noted occasional bugs and slow customer service, rating it 3 stars. 7% of customers complained about Scotiabank online bank fraud handling and marked it as 2 stars. While 3% of customers faced unresolved technical issues and hence, rated it 1-star.

Scotiabank Online Banking 2024 Final Thoughts

Experts recommend leveraging Scotiabank’s strong security, financial planning tools, and rewards programs. Suggestions include enabling real-time alerts and automating routine payments. Users are advised to explore investment tools while maintaining awareness of Scotiabank online bank technical issues to maximize benefits.