Progyny, Inc. (PGNY) is trending today due to its recognition as one of America’s fastest-growing companies, according to The Financial Times. This marks the fifth consecutive year that Progyny has received this honor. The company has also gained attention for its approach to fertility benefits, with CEO Pete Anevski highlighting the need for these services, especially for attracting younger talent. TIME Magazine also named Progyny as one of the 100 Most Influential Companies of 2024.

Description:

Customers rave about Progyny Inc (PGNY) easy-to-use platform and dedicated care advocates every step of the way.

Key Facts:

- Recent Progyny acquisitions and expansions, like the purchase of Apryl, a Berlin-based fertility platform, have added to its international presence.

- Founded in 2016, Progyny, headquartered in New York, offers fertility benefits to companies and health plans.

- Its business model focuses on IVF, egg freezing, adoption support, and fertility medications.

- The platform is built on advanced data analytics, personalized care coordination, and a network of top fertility specialists.

About Progyny Inc (PGNY) in 2024

Revenue Rockets with 42% Surge in Q1 2023

- In Q1 2023, Progyny’s fertility benefit services revenue surged 42% year-over-year, reaching $157.1 million. Pharmacy benefit services followed suit, reporting $98.6 million in Q4 2023, up 39% from Q4 2022.

- Total fertility benefit services for 2022 clocked in at $510.1 million, a 43% jump from the previous year. This significant revenue growth underlines Progyny’s expanding footprint in the fertility space.

Stock Prices Steady Amid Strong Market Interest

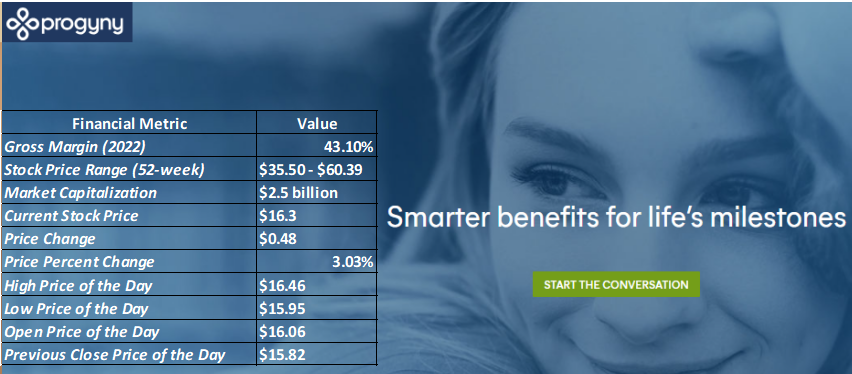

- For 2023, gross profit figures were not explicitly stated, but the company reported a gross margin of 43.1% in 2022. Progyny stock performance fluctuated between $35.50 and $60.39 within the past year, and its market cap sits around $2.5 billion. The latest stock price hovers near $16.3, with a 3% price change, showing steady interest in the market.

Strategic Partnerships and Global Expansion

- Progyny has focused on building strategic partnerships with leading fertility clinics to expand its network and improve services for patients. This strategy has enabled it to launch a new digital platform to enhance user experience.

- Additionally, the acquisition of Apryl marks Progyny’s first step into international markets, further solidifying its global ambitions. As of late, the company has also added new fertility specialists to its medical board, strengthening its expertise in the industry.

Investors Confident on Progyny Inc (PGNY)

- Stock performance in recent months has been robust, maintaining prices between $45 and $50, with a 52-week range spanning $35.50 to $60.39. Investors remain optimistic due to the company’s sustained growth and consistent revenue increases.

- Recent developments have also caught attention, such as the addition of four fertility specialists to its Medical Advisory Board and CEO Anevski’s emphasis on fertility benefits as essential for attracting millennial employees.

Social Media Links

🐦 (https://twitter.com/Progyny)

ⓕ (https://www.facebook.com/Progyny/)

🅾 (https://www.instagram.com/progynyinc/)

💼 (https://www.linkedin.com/company/progyny/)

Progyny Inc (PGNY) Final Verdict

Users appreciate the company’s personalized care and its network of top fertility specialists. Many customers report positive experiences, especially highlighting support from Patient Care Advocates. On average, Progyny ▶️(https://www.youtube.com/channel/UCxjpBP09OnyISjeHE4M7pTA) has earned a 4.7 out of 5-star rating based on 149 reviews. Key factors include customer service (4.8/5), fertility benefits (4.7/5), and ease of use (4.5/5). Overall, Progyny reviews and ratings reflect a high level of satisfaction with the company’s fertility services.