EverBank was launched in 1998 in Jacksonville, FL. It is a digital-first financial institution. In 2017, it was rebranded as TIAA Bank! Today, it leads with assets totaling over $27 billion. Customers can manage their everyday finances with checking and savings accounts. Those looking for a dream home can explore mortgage options. Let’s check Everbank Reviews 2024.

Description

Discover EverBank’s unique blend of banking services and competitive rates for savvy savers. Learn about Everbank Reviews 2024.

Key facts

- EverBank ratings across platforms reflect a blend of positive feedback.

- Trustpilot shows an impressive 4.5/5, with Google Play at a lower 2.7/5 based on fewer reviews.

- 40% customers gave an excellent 5-star rating and 35% rated it at 4-stars

- While, 15% customers gave it an average 3-star ratings

- Only 5% customers marked it below average at 2-stars and another 5% rated it at 1-star!

Analyzing Everbank Reviews 2024

A Glance at Customer Feedback

- EverBank’s customers praise its friendly interest rates, especially on CDs and high-yield savings accounts.

- Their Fees are super low for various transactions.

- Users love how easy and intuitive mobile banking is, making managing accounts a breeze from anywhere.Customer service receives positive remarks for being accessible and helpful.

- Some reviews highlight occasional technical issues, particularly with online banking, and some report extended wait times for customer support

- Users also expressed concern regarding service and policy changes after EverBank’s merger with TIAA, as this transition affected some existing account features.

Features and Services of EverBank

EverBank got you covered for all your personal, business, and financial needs. They offer high-yield checking and savings accounts that earn you some extra RoI, as their CDs also come with fixed interest rates. For homeowners, EvreBank offers FHA, VA, and jumbo loans, plus home equity loans.

Retirement accounts and investment brokerage services are also offered by EverBank. You can manage all transactions and banking activities online. Customers can access over 80,000 EverBank fee-free ATMs. They also offer financial advisory for wealth management.

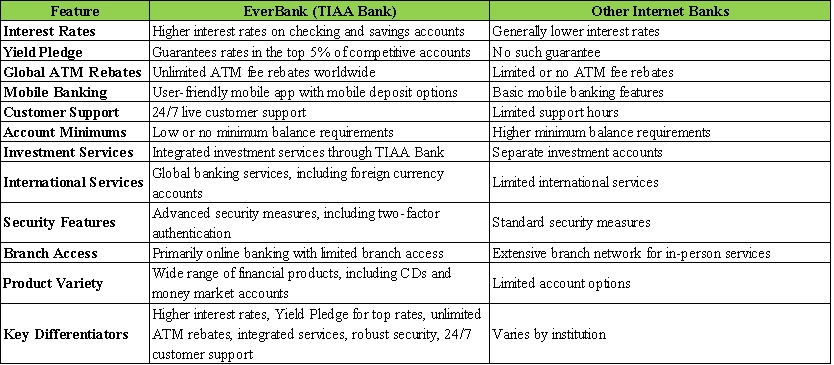

EverBank vs. Others Internet Banking

Pros of EverBank

- High-interest rates on checking and savings accounts.

- Comprehensive loan offerings, from mortgages to home equity lines.

- Nationwide online and mobile banking, including mobile check deposits.

- Access to over 80,000 fee-free ATMs.

- Responsive 24/7 customer service.

Cons of EverBank

- Limited physical branches, mainly in Florida.

- Minimum balance requirements on certain accounts.

- No independent investment products, only available through TIAA.

- Mixed feedback on online service reliability, with some users reporting issues.

- Charges for using non-network ATMs.

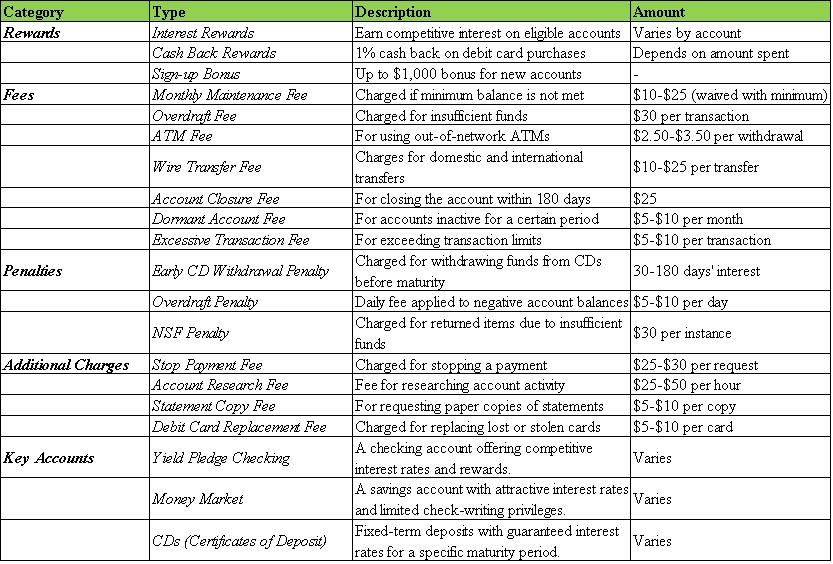

Fees and Other Charges

Everbank Reviews 2024 Final Thoughts

Experts view EverBank as a strong choice for tech-savvy clients seeking high-yield accounts and efficient digital banking. They often highlight its above-market interest rates and low fees as key benefits, particularly for clients comfortable with online banking over in-person transactions. Experts advise potential users to evaluate EverBank’s minimum balance requirements and limited branch access.

Experts also suggest considering the bank’s recent TIAA acquisition, as future changes may impact account terms or service availability. For those valuing global ATM fee reimbursements, investment integration, and competitive savings options, EverBank(https://www.instagram.com/everbank__/) is noted as a robust online banking option.

Social Media Links

- ⓕ(https://www.facebook.com/everbanknationalassociation)

- 💼(https://www.linkedin.com/company/everbank/)

- 🐦(https://twitter.com/everbank)