Aerodrome Finance is a decentralized exchange (DEX) and automated market maker (AMM) on the Base network. It’s designed to attract liquidity and reward users through a vote-lock governance model. Users can swap major assets like ETH, USDC, and EURC efficiently. Aerodrome’s unique structure, focused on liquidity incentives and decentralized governance, has driven its growth.

Description

Aerodrome Finance hits $1 billion in TVL, shaking up the DeFi landscape on Base.

Key Facts

- The combined experience of Aerodrome Finance’s founders in technology and finance has shaped the platform into a leader in the DeFi ecosystem.

- Aerodrome Finance was co-founded by Alex Cutler and Tao Watts.

- Other key contributors include Roy Degani, Ariel Alon, and Liran Kutas.

- They all brought diverse skills to the project, enhancing its decentralized finance innovations.

About Aerodrome Finance

Reasons for the spike in Aerodrome Finance (AERO):

Aerodrome Finance saw a 25.25% price increase recently, largely due to rising demand for the token. This was fueled by Aerodrome reaching over $1 billion in Total Value Locked (TVL) and efficient liquidity swaps for assets like ETH and USDC. With 100% of swap fees going to veAERO voters, the protocol attracts more users.

Aerodrome has low volatility, with only a 21.33% rate over the last 30 days, further contributing to its steady rise. Additionally, Aerodrome has outperformed 97% of the top 100 crypto assets with a 2,572% growth over the past year.

Latest Update About AERO:

Recently, Aerodrome Finance reached over $1 billion in total value locked (TVL) on Base, a Layer 2 Ethereum network developed by Coinbase. This milestone cements Aerodrome as the leading decentralized exchange within Base’s DeFi ecosystem.

Aerodrome recorded $9.02 billion in on-chain swap volume last month, reflecting its rapid growth. Since its launch in September 2024, Aerodrome has outpaced competitors like Uniswap and Aave in TVL, trading volume, and fee generation.

What is the Technology Behind AERO?

AERO is built on advanced AMM technology, inheriting key features from Velodrome V2. It integrates elements from Curve and Uniswap V2, enhancing liquidity efficiency. Aerodrome uses the Base blockchain, which ensures decentralized transaction validation and security through Proof of Stake mechanisms.

The platform’s governance model allows users to lock tokens and gain voting power, aligning long-term incentives. AERO rewards liquidity providers, contributing to the smooth functioning of the ecosystem.

What are the Real-world Applications of AERO?

Aerodrome Finance facilitates seamless cryptocurrency swaps, allowing users to exchange assets like ETH and USDC. AERO’s liquidity pools help maintain market stability by ensuring enough assets are available for trades.

Aerodrome’s governance model enables token holders to vote on important protocol decisions, ensuring community-driven development. Liquidity providers earn rewards from fees generated on the platform, while traders benefit from low fees and efficient swaps.

Social Media Links:

- (https://x.com/aerodromefi?lang=en)

- (https://warpcast.com/aerodrome)

- (https://discord.com/invite/aerodrome)

- (https://debank.com/official-account/113905)

- (https://github.com/aerodrome-finance)

Aerodrome Finance Final Verdict

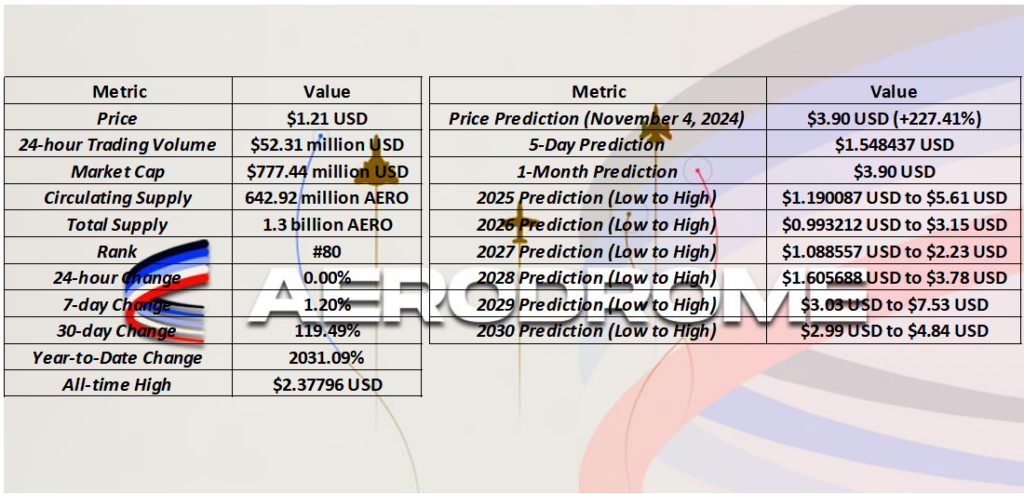

Aerodrome Finance(https://www.youtube.com/watch?v=7sGIxqKN6_o) shows promising growth, with a 2031.09% increase this year. Its price surged 119.49% in 30 days and is expected to rise 227.41% by November 2024. Short-term investors could benefit from rapid price increases, while AERO long-term investors might prefer stability with yearly lows around $1.19 and highs reaching $7.53 by 2029.